Situated in Mumbai, Chhatrapati Shivaji Maharaj Vastu Sangrahalaya, formerly known as the Prince of Wales Museum of Western India, is one of the premier art and history museums of India, and a major tourist attraction. We created the site with a provision for e-commerce in the future as they’re looking to make their beautiful shop collections available for purchase online as well.

BzEd Corp offers not only a comprehensive range of business and corporate services such as investment, capital raising, business setup, expansion of business, trading and business network connection, but also offers essential subsidiary services including Australian settlement, recruitment, visa and immigration services through BzEd Corp's corporate division.

The difference between something good and something great is attention to detail. This thought stayed with Baystitch founders Varun Vora and Abhishek Patel through every stage of creating their brand. Due to a lack of quality pieces available at fair prices, Varun and Abhishek with backgrounds in finance, construction and industrial manufacturing, combined their skills towards a driving passion to discover the right balance between clean, refreshing and dynamic design, leading them to embark on this Baystitch journey.

You might be publishing content that is well written and actually useful to visitors, but if your overall digital content marketing strategy isn’t defined and executed in the right manner, your content won’t be as visible as it should. There are many content marketing tools available that help you optimize, publish and distribute your content. Here are some of the most popular ones to help you along the way:

SEMRush

SEMRush is an excellent program for conducting keyword research and finding new keyword ideas that will work for your business. The program is subscription-based, and allows you to carry out various functions competitor keyword and SERP (Search Engine Ranking Position) research and backlink analysis and quality checks for off-page optimization.

It is fairly simple to use, and can help you figure out which keywords will work best for your websites. SEMRush’s tutorial is also very straightforward and gets you up and running in no time.

BuzzSumo

BuzzSumo helps you identify high quality content on topics that are relevant to you so you can get content ideas and inspiration and see what’s currently working for others. It also helps you identify the key influencers for a given topic, allowing you to better shape your digital PR strategy and promote your own content.

NinjaOutreach

Similar to BuzzSumo, NinjaOutreach is a blogger-outreach software CRM that helps you identify key influencers. In addition though, it also allows you to reach out to influencers from within the tool itself, making it easier to operate & monitor your outreach efforts. NinjaOutreach can help you find relevant content ideas, view the number of shares, and find out who shared them.

If you have a large enough influencer list, you’ll also find NinjaOutreach’s outreach automation features very useful.

WordTracker

Like SEMRush, WordTracker is a keyword research tool that gives you keyword ideas and suggestions based on your product or service.

The tool helps you figure out how much traction a keyword will get over the month and how much competition you can expect to face when optimizing for that keyword.

Buffer

Buffer is a great social media sharing and scheduling tool. It allows you to schedule all your social media postings and updates so they automatically go up at the times you define, making it easier for you to execute your social media strategy. Just draft your social media posts and load them into a queue, define where you want them sent, and Buffer will update them in the right formats at the right times.

RankTrackr

RankTrackr shows you Search Engine Ranking Positions (SERPs) for your own domain as well as your competitors for all your related keywords. It also generates reports based on any locality you define, so you can see the results Google shows visitors based on their actual location. So, for example, even if you’re physically in Mumbai, you can see what results Google will throw up for a visitor from New Delhi for a given keyword.

You can set up automated email reports and analyses, and also see the past trends of keywords with historic search engine ranking reports. Rank tracking is usually very difficult to gauge accurately due to the dynamic, ever-changing nature of Google’s search algorithm, but Ranktrackr is considered to be one of the most accurate keyword rank tracking tools.

Wordstream

Wordstream is a cost effective PPC campaign management tool. You can save a lot of time creating, analyzing, optimizing and reporting on your Paid Search campaigns with Wordstream. It also has landing page templates and call tracking as features that both save time and tangibly help you measure RoI on your campaigns.

As a company that offers Digital Marketing Services, we’re keenly aware of the importance of content marketing on the web today. Content generation and marketing is also a big part of SEO today, and we help you unify the voice of your content marketing strategy so that it takes into account Search Engine Optimization, Search Engine Marketing as well as Social Media Marketing. Contact us to learn more about our Digital Marketing Services.

Studies conducted by the Association of Certified Fraud Examiners show that employee expense claim frauds make up 15% of all business fraud - a significant chunk. ACFE also indicates that on average a period of about 24 months is needed for expense report frauds to be detected and substantiated with proof.

If you suspect your employees are taking advantage of the company expense management processes, then the following are some signs to watch out for:

1. Employees spending more than their peers

Staff members with identical job descriptions or comparable positions in your organization should have similar expenses.

For example, say you have two employees John and Maxwell at the same position in your organization. If Maxwell expenses are about $2000 and John’s $9000 in a month, you should take a look at John’s expense report for some time. He could be manipulating amounts or making fictive claims.

When looking at spending trends, try to see if they correlate with your ROI. Employees with higher expenses should at least be able to justify and link those claims with higher income generation.

Standard policies should define the types of places employees of different ranks stay and eat at when on business trips.

2. Inflating acceptable expenses

Whenever possible, request a receipt for every expense claim. This is because a dishonest employee could try to marginally inflate expenses – not by much, just a few rupees or dollars – here and there. Suddenly what should be a Rs. 15 bus ride becomes Rs. 20, which is easily overlooked since it’s such a small amount. As a single case, the above example doesn’t seem too serious. But imagine 100s or 1000s of these inflated expenses occurring every month, they can really add up and cause significant drainage of company resources.

Two Zento features that enable you to curb this are a) allowing you to place an upper limit on reimbursements allowed without a receipt, and b) allowing you to analyze previous trends and find anomalies

3. Claiming non-business related items

Employees and managers alike should be educated on what actually counts as a chargeable business expense. A junior employee indulging in a luxurious and expensive 10-course meal probably won’t be looked at too kindly if he charges it to the company. To reduce or stop expenses of this type, your company needs to be very selective about the types of expense claims allowed.

This can also be accomplished by educating employees and managers. Charges accepted by managers should always be fair.

Granted, some job profiles might command higher flexibility in spending, such as those related to sales and client servicing. A look at your ROI should help you determine what’s important for your business. There should be a clear understanding of expense limits and that employees will be held accountable should they cross these limits.

4. Double billing

Watch out for employees that double bill by using devious methods like charging expenses twice, under different trips or on different days.

Also, some employees may use company credit cards for a purchase and later submit a receipt as if the same purchase was made using cash.

Zento allows you to set controls that help identify duplicate transactions and send you automated alerts. Your finance department has its work cut out by not having to manually crosscheck paper statements or spreadsheets to catch duplications.

5. The company card being abused

Corporate credit cards are often provided to employees who rack up significant business expenses since it simplifies payment, tracking and consolidation. The HR and Finance departments get a consolidated view of card activity.

However, a drawback to this is that your employees may end up spending more than the necessary amount. When the company credit card bill arrives, you should take the time to review the charges before signing a check.

You might also want to consider prepaid debit cards for travelling employees. Here, it is possible for you to set the spending budget for trips way before time. With this in place you prevent your employees from overspending by keeping them budget conscious from the get-go.

The takeaway

Good expense policies and automated expense management systems like Zento can dramatically reduce cases of fraudulent expense claims and reimbursements.

If you are struggling to monitor and curb employee expenses or need a better way to enforce spending policies on your employees, Zento will help you both govern and authenticate your employees’ expenses as well as facilitate legitimate reimbursement.

Zento is a cloud-based (or on-premise) employee expense reimbursement solution that benefits both managers and employees with its simplicity and intuitive features. Replacing outdated expense management systems with Zento enables companies to develop an efficient expense settlement process that is easy to implement and provides instant results. Zento can also be customized according to an organization’s unique policies.

Here are some of the benefits Zento provides to Employers and Employees:

Employer Benefits:

Employers will benefit from greater process efficiency with Zento’s cloud-based employee expense management solution. Saving precious time and energy, Zento simplifies the process of accounting for employee expenses and reimbursing claims. Employers are able to do away with expensive check processing by utilizing Zento’s cost efficient electronic disbursement system. Superiors at any given point of time have a snapshot of all outstanding expense claims – categorized by type of claim, operational department, location, business vertical and more.

Instead of waiting for employees to return from business trips and turn in disorganized stacks of receipts, some of which are bound to be missing, Zento’s central processing system enables immediate submission of expenses as they occur. Zento also has checks in place that greatly reduce the chances of fraud, like double claims against the same expense and inflated expense reporting.

Employee Benefits:

Traveling employees are those most likely to encounter expenses that require reimbursement. The cloud-based nature of Zento enables them to submit and begin processing their disbursement immediately. The convenient Zento system can be used from any location and device with internet access. No longer will employees need to wait until they are back in the office to submit expenses and then follow with another wait for a check to be prepared. With Zento, expenses are accounted for as soon as they are entered, which significantly reduces the chances of bills and receipts being lost along the way and employees forgetting expense amounts and details during hectic times.

Employees will enjoy the ease of organizing their work related expenses and expediting the reimbursement of the funds they have spent. Zento’s user friendly, customizable interface has been developed to be intuitive for simplicity of using each of its advanced tools. Claims are quickly submitted and issues can be resolved via an annotation system that allows timely, purposeful communications.

Customizable Features:

Zento provides maximum efficiency for your company through clever customizable features that enable you to personalize your employee expense management process to the way you do business. The security parameters that are built in to the Zento system ensure that access is limited to those who should have it, while still allowing for mobile access by employees on the go. Your Zento implementation will include integration with your existing accounting software for seamless processing of expenses and disbursements.

Zento will also be customized to include any unique management reports necessary for approval and analysis of employee expenses. Single click approvals make processing standard expense claims quick and efficient, while greater examination and annotation options are available for more complex claims. Easily scalable to any size organization, Zento offers you the innovative tools that you need to simplify your employee expense management process.

Zento optimizes your employee expense management processes for cost efficiency, increased productivity, and compliance with tax and labor legal requirements. The reporting and audit functions that are built into the Zento system will save time and simplify your reporting processes.

For more information on how the Zento employee expense management system can revolutionize your business, contact us today!

Travel & Entertainment expenses – often dubbed T&E – tend to be the 2nd or 3rd largest business operational overhead, after salaries and rent. Garnering such a big chunk of business expenses and being the sort of expense category that can be flexibly controlled, T&E usually comes under the limelight when a business takes a call to cut operating costs or bring about business process efficiencies.

T&E is a popular OPEX item to focus on when in cost-cutting mode. As much as face-to-face interaction helps in business dealings, web-conferencing solutions these days are immersive yet cheap. Entertainment expenses also take a backseat,as their criticality is less justifiable than components like salaries & wages. Controlling T&E

CEOs, CFOs, HR Directors and people in other Finance/HR/Management positions tend to think about cost-cutting measures. Strategic decisions to pay attention to rising operational costs and questions like “how can we curtail unnecessary T&E expenditure” typically stems from people in these profiles.

Addressing this can be difficult when the data you need to make an informed decision is fragmented and nonsensical. Further, coalescing all this data into Management Reports and Historical Analysis is the key to defining tangible, actionable measures.

With a cloud-based Expense Management Solution like Zento, all T&E related business expenses are not only properly recorded, they can also be structured in completely customized ways to help Management/Finance/HR glean actionable insights. You can see which modes of transportation are most frequently being used and the net expenditure on flights/trains/buses/cabs, how often people are traveling and whether that much travel is really justified, how much a particular department is spending on travel & entertainment and whether they can bring it down a notch, which employees are being mindful of company money and which are not, region/department/individual wise expenditure, and many other important variables.

Zento will not only consolidate your company’s T&E expenses and help bring about cost efficiencies, it will also give your employees the comfort of knowing that if they spend from their own pocket for a business expense, they will be reimbursed, quickly. A T&E Solution like Zento makes it easier for everybody in the organization to adhere to the T&E Policy, while facilitating the T&E expense claim process and giving decision makers the information they need to optimize processes and reduce operating costs.

Every business has expenses, which of course have to be processed and dealt with — be it using Excel or an expense management software. Most businesses still rely on paper-based reporting, which is impossible to automate and extremely slow to process. Instead of paper-based expense reporting, a dedicated cloud-based travel & expense management solution like Zento will make life much easier for your HRA & Finance departments.

Here are six reasons you should cut out paper-based reporting all together:

Humans make mistakes, software doesn't.

Even the most meticulous humans can make mistakes. They forget to double check their receipts, enter something twice, or forget to enter it at all. Software that creates automated expense reports will not only eliminate the opportunity for most human errors, it will also check for and alert the user to any information that is incorrect, entered twice, missing, etc.

Administrators have more control with software.

One of the biggest benefits of expense reporting software like Zento is the ability for administrators and other auditing parties to have greater access to relevant information. Zento will even let administrators set up policies that make it impossible for employees to break essential expense reporting rules.

Expense Automation speeds up the reimbursement process.

Especially if you have employees or departments that often use their own money for travel, events, tools, etc. Since expense approval with Zento makes the entire reporting and reimbursement process faster and easier, those individuals or departments will be far more satisfied and confident spending from their pocket on behalf of the company resting assured the reimbursement will be swift and error free.

Reconciliation with accounts.

If you already have accounting software, integrating expense-reporting software is often a simple process. This makes it possible for you to combine the two pieces of software that manages your business’s money, which means fewer errors and much better communication between accounting and the rest of your business.

Makes your business more efficient, which makes it more profitable.

If your employees are spending a lot of time manually entering information into expense templates, they are not free to actually do their jobs. Paper-based reporting is a time-sink for employees, for managers, and for your accounting department. Automated reporting software makes the entire process much more efficient which allows everyone to get back to work faster.

Save Paper.

Automated, online expense reports and other paperwork related to the expense management process can be drastically reduced or eliminated altogether. This results in a two-pronged benefit: you reduce your company’s impact on the env

If you want fewer mistakes, more control, and a more efficient reporting and reimbursement system, switch to an expense reporting software like Zento. Contact us to find out more.

Every company has its own unique HR & Admin policies. However, there are also rules that are generic and apply universally to working professionals. One such universal understanding is that employees are reimbursed for any T&E expenses incurred by them during travel or client servicing.

Let’s take a look at some of the guidelines that tell us when expenses fall into the T&E category:

- If you travel away from home for business purposes, you can deduct your transportation costs, meals, lodging, cab fares, and the like.

- The meals should not be extravagant, unless of course the situation demands, in which case you can go ahead with your HR rep’s permission.

- Usually, the entertainment activity must take place in an atmosphere conducive to discussing business. Hence, if it is considered ‘directly related to’ your business you can expect a re-imbursement. In some cases, entertainment expenses incurred with the primary intention of generating goodwill can be considered.

- Lavish or extravagant entertainment is often not approved as a deductible. Entertainment is associated with your business if it occurs before or after a business meeting. If the client comes from out of town, the business discussion can take place the day before or the day after the entertainment.

- Reasonable business calls incurred during travels, usually limits are set according to employee designation and profile.

Personal extensions to business trips and personal shopping expenses are, by the norm, not considered as reimbursable.

For most companies, the records for business travel must show:

- Date of commencement and arrival

- Reason for business trip

- Cost and bill of each travel expense For most companies, the records for business related entertainment must show.

- Date, location and nature of the entertainment

- Amount spent on the entertainment

- Business reason for the entertainment or the benefit you expect to derive

- Details of the substantial business discussion (for example, date, duration and nature of the meeting) for any, associated-with entertainment

Zento allows you to easily formulate and set custom rules and checkpoints as part of your company’s travel & entertainment expense claim policy. These rules can be altered whenever your policies change and you can also amend these rules based on employee position/role/department etc. To learn more about how Zento helps manage T&E Expenses, get in touch with us.

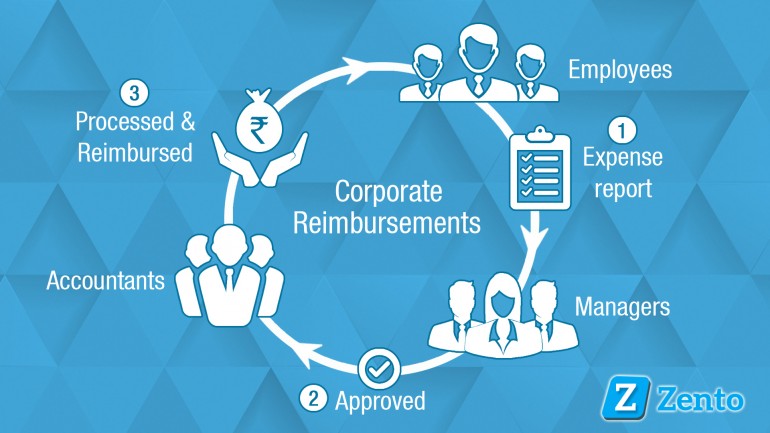

Employee expense settlement is a laborious, complex and time consuming process for both parties - the employee and the company. The company deploys certain guidelines and regulations that need to be adhered to while applying for the claim. Most of the time, gathering data and submitting it to the accounts department is so cumbersome, that the employee waits until the last moment to submit it. The accounts department then needs to manually go through claims, verify all attached receipts and bills, and pass the claims accordingly. These tedious procedures justify the need for an employee expense management system like Zento that greatly simplifies the entire expense claim process.

Let’s take a look at 7 issues that can make expense management a chore for your business, and how an expense management solution can resolve them:

1. Fraudulent documents:

Expenses can be forged, and fake bills can be made by an employee. This results in the company shelling out more money than needed. With expense management software, the company can assign policies that make capturing & supporting expenses made by employees mandatory, thereby eliminating any doubt of a false reimbursement.

2. Reclaiming VAT and other taxes:

When calculating VAT charges from bills and payment slips, a lot of information can mistakenly slip through. Determining the correct amount of taxes & duties, locally and internationally, is difficult to do manually. Location-based policies in expense reimbursement software records business costs and helps determine related surcharges accurately.

3. Lost receipts:

Occasionally, either an employee or the reporting manager might misplace an entire bundle of receipts. This can lead to bitterness between the employee and management as it can take months to sort out the commotion. As the employee uses the software to capture all his business transactions at the time of payment, the management can pull up the details from the software in case of loss of receipt.

4. Over-working at the end of the month:

As the claim process is very cumbersome, most employees wait until the last moment to submit their claims. This puts extra pressure on the management during the end of the month as they need to close accounts for that month. Since submitting claims is much easier on Zento, managers can approve claims as and when they appear, instead of all at once, which helps accelerate claim approvals, making the employee feel reassured when spending personal funds for business expenses.

5. Waiting:

Once the claim is submitted, the accounts department will only process the claim payments in the next payroll. Employees might have to wait more than a month for their claims to be reimbursed if they miss the submission deadline. The software accelerates this process, as it records costs and claim details on the go, and the employee can immediately file his expense claim.

6. Filling excel sheets with claim details:

Updating excel sheets with claim details by adding formulas and details is an excruciating process. An intelligent system like Zento with ready made formulas that calculates expenses immediately on input is the answer to this problem.

7. Going through credit card statements manually:

When management has to manually search credit card statements and verify them with card transactions it cuts down on their productivity. With Zento, they can match expense claim lines with credit card statements.

Zentois a simple, intuitive, cloud-based application that eradicates the manual calculation of expense costs, which takes up significant time that could be spent more productively. Contact Zento to learn more.